Behavioural red flags of fraud...

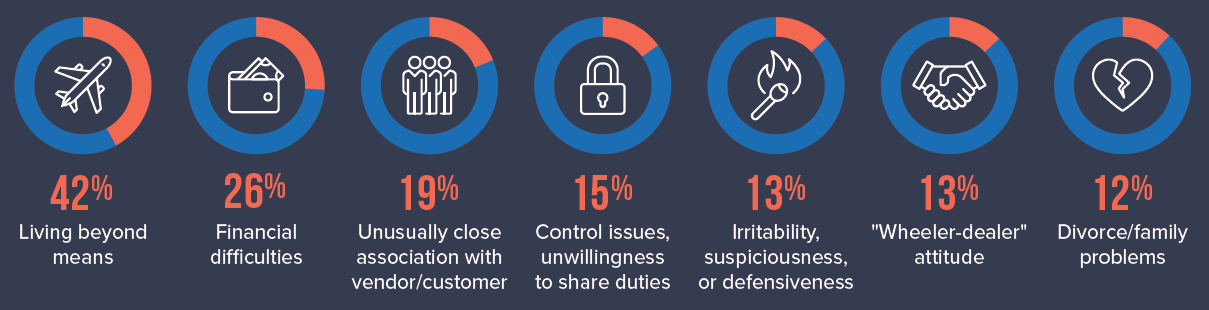

Fortunately, fraudsters display some common tell-tale signs that can help us;

85% of fraudsters display at least one of the red flag behaviours listed below and identifying them can help to target counter fraud resources effectively.

So how does this information help you if you're an employer?

For example, you may have a relatively junior employee who takes exotic annual holidays, drives an expensive new car, or wears expensive clothing or jewellery. It doesn't necessarily mean they are committing fraud against you but you may wish to look in more detail at any financial transactions they are involved in at work.

Identifying one or more of the red flags can also help you to prevent fraud occurring by intervening early. For example if you become aware that an employee has financial difficulties you may be able to provide support and/or restrict their opportunities to commit fraud.

A number of the identified red flags relate to job performance, including:

- unusually close relationships with customers,

- control issues/unwillingness to share duties.

A fraud perpetrator’s job performance will often suffer while they are committing fraud, this can include excessive absenteeism, poor performance, and lateness. Whilst these signs alone don't necessarily mean they are committing fraud against your company, if you are already aware of losses they may provide an indication of potential culprits.

If you would like more information about how SAFE can help your business identify and prevent fraud please get in touch for an informal, no obligation chat.

Share this news story...